Domestic banking industry is encountering history on infrequent " Qian Huang " . Last week interest rate of short-term loan of a person of same business between 4 Shanghai bank (SHIBOR) violent wind rises 578.4 base point to come the perch of 13.4440% , 5 big make the sign that controls price of capital open quotation together last week relatively apparent, but liquidity situation still nots allow hopeful.

Although be put in short-term factor, but the expert thinks, this " Qian Huang " reason of deeper administrative levels, as incontinent as banking still dilate is concerned. And the Central Bank does not turn on the water stoutly, criterion meaning in force a bank to improve fluidity management further, give the dilate of business of a person of same business with a few fast banks to ring noisy alarm bell.

Be troubled by " Qian Huang "

Result from the bank is incontinent outspread

Earlier before on June 20, violent wind of interest rate of short-term loan of of the previous night rises 578.40 base point, rise to 13.4440% , the market was immersed in panicky condition. In market of the national debt between the bank, appeared all fronts steeps fall, the member that great majority shows certificate to trade is forced undersell bond, 1 year period national debt mixes 10 years period national debt occurrence interest rate hangs a situation.

And last week 5 namely on June 21, interest rate of short-term loan of of the previous night considerably fall after a rise 495 base point, to 8.492% , interest rate of 7 days of short-term loan drops 246.1 base point, to 8.543% free norton internet antivirus; And 14 days of interest rate continue to rise 97.2 base point, to 8.566% , 1M interest rate rises 29.9 base point, to 9.698% . Nevertheless, inside course of study the personage looks, as the drawing near that end of half an year assesses, each finance orgnaization especially the bank is right of capital long for will last, in future inside period of time, the trend of insecurity of area of the financing between the bank still will last.

The personage inside course of study thinks generally, erupt this " Qian Huang " , with the coming assessment in year and foreign currency the atrophy that take a money is concerned. Data shows, 2012, month of end of season of deposit of RMB of countrywide financethe best spring pool orgnaization increases 2.3 trillion yuan on average, and the month at the beginning of season reduces 511.5 billion yuan on average. Putting borrow the effect that compares assessment to fall, whenever be nodded when the key, the bank can be thrown " grab Qian Dazhan " in go. Additional, public data shows, foreign currency occupied a paragraph to increase a RMB May sixty-six billion eight hundred and sixty-two million yuan, relatively two hundred and ninety-four billion three hundred and fifty-four million yuan new increment was reduced considerably April 77% , business having ticket predicts even, foreign currency occupied a paragraph to may be in the condition that drops completely in June.

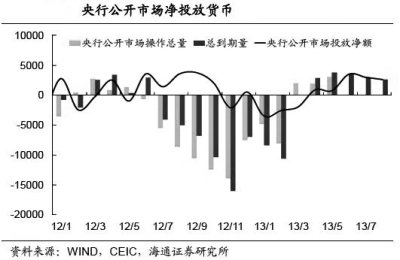

China peaceful negotiable securities is presiding economist Liu Yu brightness say, on June 1 of become effective " the announcement that bureau of national exchange control concerns an issue about strengthening foreign currency capital to flow into management " make hot Qian Liu enters speed slow down. In addition beautiful couplet store the anticipation of cut Q E increases, also increased those who heat up money to escape. And Central Bank scale did not move closely to fluidity hasten to intervene easily, farther aggravate the tight situation of capital.

Nevertheless, in economist people look, banking this " Qian Huang " reason of deeper administrative leveharrison hot spring weather forecastls, as incontinent as oneself of course of study of Bank of China still dilate is concerned. Chinese the State Council develops Zhang Chenghui of director of institute of research center finance to think, the situation with the financing exceeding and tight area that the market between the bank appears, because current monetary policy will be tightened up,not be, go a few years however the commercial bank is follow one's inclinations outspread oneself business dimensions, the concentration after reaching a the limit erupts. She says, conduct financial transactions of superintendency branch aggrandizement is superintended and increase to crossing condition the superintendency of arbitrage, also bring about each bank to need to increase capital to add up to rule requirement in order to satisfy. And partial bank is blind to fluidity hopeful, did not make good fund control, loan has increased fierce. spring pool

Guo Taijun installs senior economist Lin Caiyi to express, since this year, as the ceaseless enlarge of leverage, the RMB of the commercial bank has Fu Jin is in above quota drop gradually, end had Fu Jin is led above quota in March i want modern dining chairsfrom last year of the end of the year 3.51% fall to 2.58% , 2 quarters, super- store rate continue to drop, estimation of the personage inside course of study has fallen 1.5% the left and right sides, the limit of bank system fluidity bears force also drops greatly accordingly.

Zhang Chenghui points out, current M 1, M 2 and social financing gross are added fast faster, but capital did not flow into hypostatic economy, enter partly however produce can superfluous industry, this exterior cent capital is used at repaying captital with interest inchoately, capital is in in great quantities idling of financial system interior, did not enter hypostatic economy.

Big gain weichis

The Central Bank continues aggrandizement fluidity management

Liquidity situation is tightened up make a commercial bank appeal the Central Bank reduces deposit reserve to lead, with to capital of market infuse more. But the Central Bank did not move. The analysis thinks, actually, the market between vancouver to harrison hot springscurrent bank is not to lack capital, however the orgnaization is too pessimistic; Additional, bank innovation goes buy the business that return carry out, turn credit business into capital business, turn the fund that is used at short-term loan of a person of same business into shadow asset to be locked up dead, the Central Bank not " turn on the water " undertaking controlling to the risk of these shadow asset just about.

A few days ago, the monetary credit situation that the Central Bank holds analysed the conference to make judgement to situation of near future currency, include the 3 big questions that the near future exists among them, "It is monetary market wave motion, partial bank pursues wholesale business of wholesale a person of same business for a long time Wu, deadline fault deserves to comparative tall, bring greater pressure to fluidity management; 2 it is credit increases had appeared fierce impetus; 3 it is credit structure still unreasonable. " disclose according to be close to the personage of know the inside story of the Central Bank.

north face shirtsSpecific and character, the Central Bank points out, before one phase, partial bank is opposite comfortable fluidity is blind and hopeful, to the element underestimate of a series of influence fluidity that will appear in June, include cash of reserve filling capture, imposition clear capture, holiday to put in, cash of compensatory foreign currency and foreign enterprise dividend distribution, loan is added more etc, measure does not reach the designated position. A few big did not develop the market one class trades the action with due business, bring about monetary market value to fluctuate considerably.

Put in to credit, the Central Bank thinks, a few banks think the government can publish outspread sex policy in process of economic be issued to lower levels, ahead of schedule layout is occupied. Central Bank exposure, in June the first ten days of a month, countrywide bank credit increases nearly -727379968, achieve the history most, especially notable is, in 24 main banks, the limit that has the bank of the half 10 days this addition loan is more entire in June than its months is much still, mail among them store the bank is put borrow 1000 much, letter bank is put in borrow 500 much, bank of the people's livelihood and restful bank all are put borrow 300 much.

So large-scale credit jumps is loan structure rear unreasonable problem. Personages of afore-mentioned know the inside story disclose, "The Central Bank points out clearly, bank of before June 10 days of whole nations adds the 70% above in loan newly is bill, partial bank money is occupied those who compare is tall need to pay close attention to especially, heng Fengyin is occupied all right than 98% , pu Fayin is occupied all right than 94% , guang Dayin is occupied all right than 79% , this cannot last not only, still put in potential risk, and run-of-mill loan increases not much, this is considered as credit idling, bank to back small small company by each, 3 farming the policy that waits for hypostatic economy did not fall to real point. This is considered as credit idling, bank to back small small company by each, 3 farming the policy that waits for hypostatic economy did not fall to real point..

To leaving the job of one phase, the Central Bank makes known his position to will continue to strengthen fluidity management. It is reported, the Central Bank is clear on the meeting, the bank must improve oneself fluidity management, big travel should produce effect of good market stabilizer, a few major paroxysmal problems want to be reported in time to the Central Bank, the liquidation issue that if attemper because of capital,brings, can mention report for duty branch of letter of Central Bank goods is harmonious solve. Anyhow, as long as it is systematization risk, want a bank only each field work arrived, the Central Bank can give support.

Additional, in monetary policy respect, the Central Bank also won't change the monetary policy that keeps dovish next, both neither will be comfortable, also won't tighten up, emphasize around " stable policy, optimize structure, promotion service, be on guard risk, deepen reform " 5 respects spread out, ask it is control credit gross, good to hold put in rhythm, if 2 quarters put in the bank little at limitation, those who have balance is OK leave second half of the year to use.

Go lever

Must take fault of term of the best selling watch casescapital of a person of same business seriously to match

To the fluidity foreground of the market between prospective bank, the analysis thinks, shortly will come in July, the bank will turn a share out bonus, the enterprise also will have finance pay money. If the Central Bank continues not to turn on the water, the Qian Huang of the market between the Bank of China, will continue. Although once came out before this " big Central Bank forcing the king or emperor to abdicate puts in capital " message, nevertheless, the orgnaization that expects the Central Bank turns on the water again wants disappointment. The personage inside course of study expresses, the Central Bank this determined not " turn on the water " , namely meaning its are accelerated to go in press bank the process of lever. "If allow to develop by shadow bank, the bank has a problem really. " the personage of know the inside story that is close to the Central Bank points out.

Before this, superintend a successional hold a memorial ceremony for to give silver-colored inspect to meet market of the bond between 10 8 article, article, bank clears rectify wait for adjusting control method to restrain a bank to cross fast credence to expand, but the credit dilate of the bank sthe best selling north face shirtstill is continueing.

Institute of finance of company division courtyard released a few days ago " the development of market of product of conduct financial transactions of shadow ——— China of shadow bank and bank and evaluation " point out, bond is bought and business of a person of same business is " the shadow of the bank " main component, meanwhile, the credit creation activity that the bank buys bond and bank extend the mechanism of credit is same, and the credit creation of bank a person of same business should concealment and complex much. Report of company division courtyard points out, via calculating, the dimensions that undertakes through business of a person of same business credit is created rises by the 2 trillion violent wind 2009 to 2012 nearly 12 trillion of end.

Business of financiharrison hot spring dealal orgnaization a person of same business basically includes a person of same business to deposit, short-term loan of a person of same business, counter-purchase wait for business, involve bond, loan, bill and be benefited the category of a lot of asset such as authority. The road points out fully, include the 4 financial orgnaizations of Chinese that go inside greatly in recent years dimensions of asset of dilate of market of a personfree watch case of same business of by way of will get tall get one's own back, because the bank passes dimensions of credit dilate asset to suffer,be restricted, and capital of business of a person of same business takes up and policy is superintended opposite less, and become bank orgnaization to add lever, the first choice of outspread asset dimensions. The bank starting line of business that with business of a person of same business expression highlights is exemple, rate of total lever of this finance capital from 2010 of end 20.76 times fall up to now year 19 times first quarter, the rate of lever of a person of same business of the corresponding period comes from 4.72 times litres however 6.7 times.

Liu Yu brightness points out, be superintended for avoid and managing cost, silver-colored guild seeks a bank crossing the bridge, through sending put in order belongings is tasted or certificate decides to endowment canal, corresponding and fiducial accredit and bill authorization, return carry out to perhaps buy product of conduct financial transactions again, change its into asset of a person of same business, but it is brushstroke credit business actually. Invest with capital of a person of same business nonstandard spend creditor's rights capital fund (blame mark) business, make professional work of sign of Bank of China expanded first half of the year to this year last year especially the fiercest, leverage rises quickly.

A banking personage is right " economic reference signs up for " say frankly, in the past, superintendency layer also can do some of pressure test from time to time, the result comes out is everyone is happy more very, but, arrived real market occurrence wave motion even the crisis when, ability sees who is " naked swim " .

Ba Shusong of assistant director of institute of finance of research center of development of the State Council thinks " wave motion of short-term money market examines risk of financial orgnaization liquidity runs ability. Run a mechanism with current monetary market, the Central Bank should iron the fatigue that makes the same score wave motion of short-term interest rate to should belong to raise the most popular selling norton internet antivirusone's hand, but, fluctuant itself runs ability to the liquidity risk of financial orgnaization is a check-up, expect the near future a few pairs of fluidity are blind and hopeful, right the financial orgnaization that liquidity risk management prepares to be not worth, can pay tuition, especially the near future matchs remarkable orgnaization in fault of time of market of a person of same business. Especially the near future matchs remarkable orgnaization in fault of time of market of a person of same business..

No comments:

Post a Comment